There it is. That thing you've been wanting for months now. What is it? It could be a bicycle or a skateboard. Maybe it's a new laptop or a tablet computer. Perhaps it's a cell phone or a new pair of soccer cleats.

If you only had that one thing, you'd be so happy. But it's expensive. And you don't have the money to buy it. What can you do? Working for spare cash and saving your money over time would work. But that might take a while.

Maybe you could borrow the money from a friend or family member and pay them back over time. That way you could have what you want now and pay for it later. Doesn't that sound great? There's only one problem: you have to go into debt.

What is debt? Debt is an obligation to repay someone money that you have borrowed. Incurring debt usually involves paying interest, too. Interest is like a fee paid to the one you borrow from for the privilege of using their money for a period of time.

For example, if you borrow $100 from your parents to buy a new bicycle, they might have you pay them back $110 over time. That extra $10 — 10% of the total borrowed — is a fee that reimburses them for the use of their money.

When banks lend money to their customers, they charge interest, too. That's one way banks make money to stay in business. Banks lend money for all sorts of reasons, like to buy a new house or car.

You can also go into debt by charging purchases to a credit card. Banks issue credit cards to allow people to purchase things they need or want and pay for them over time.

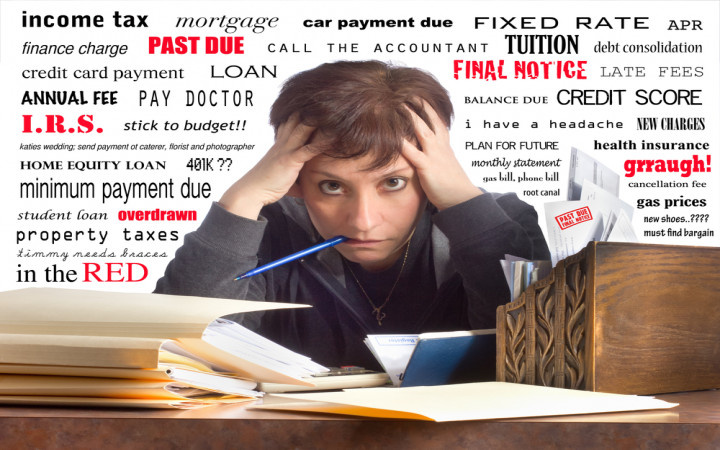

Unfortunately, debt can become a huge burden if you're not careful. Borrowing too much money can make it difficult to stay on top of your finances. When you owe more money than you make in income, people say you're “in the red."

This phrase comes from the old accounting practice of showing negative numbers on a ledger in red ink. Black ink represents positive numbers. So if you're making more money than you're paying out in expenses, you're “in the black."

Most people have to go into debt at one time or another for various reasons. For example, to go to college, you may need to borrow money for tuition. Likewise, houses can be very expensive. The only way some people can afford to live in a house is to borrow the money from a bank.

You can pay for these items over many years with the income you make from a job. You just need to be careful not to borrow too much money, or you will soon find that your income does not cover the debt payments you need to make. Then you'll be “in the red" and that's not where you want to be!